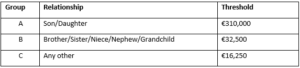

Capital Acquisitions Tax (CAT) is a charge on both inheritances & gifts over certain limits.

With Revenue receipts from CAT up over 65% since 2011 this area of taxation has become more and more researched when it comes to providing for your nearest and dearest, in the most tax efficient manner possible.

Whether you have accumulated personal wealth, or it is tied up in your business, there are various reliefs and areas of planning you can implement to ensure that as much of that hard-earned wealth remains in your family.

Who and what is taxable?

A CAT liability of 33% may apply where:

- The beneficiary is Irish resident

- The disponer (person gifting or leaving a benefit) is Irish resident

- The gift or inheritance consists of Irish property e.g. Irish property or land

Example

Mary received a taxable gift from her Father in 2005 of €20,000

Upon the death of her Father she inherits the following:

Cash €50,000

Family Home €300,000

Total benefits received €370,000

Relevant Group A Threshold €310,000

Taxable Amount €60,000

CAT Due @ 33% €19,800

Revenue consider the following as “normal payments” and therefore may not fall within the scope of CAT:

- Free use of the family home

- Educational costs include free accommodation for college

- ‘reasonable’ wedding contributions

It is important to remember that CAT is a self-assessment tax. A CAT Return must be filed with Revenue Commissioners where the inheritance/gift either by itself or when aggregated with prior gifts exceeds 80% of the appropriate tax-free threshold amount mentioned above.

The above article is for general use only and does not constitute advice. It is accurate based on date of publication and further clarification on possibly rule changes should be sought. If we can we be of further assistance, please do not hesitate to contact us.